Cash management for small businesses

Date posted: 17.04.2014 | Author: Harry Bovensmann

The last thing small business owners want over any holiday period is a cash management crisis that could result in financial harm to the business and pain for staff and or customers.

Referring to the upcoming Easter and holidays in May, Ravi Govender, Head of Small Enterprises at Standard Bank, said an effective cash management plan could mitigate against potential risks at a time when increased spending by consumers is likely to result in higher turnover.

Cash management is the way that a company handles all aspects of the financial end of the business, like collection of revenues and investing of cash and other assets. This is necessary for a company to stay afloat and solvent. Although cash by definition refers only to paper or coin money, in cash management, companies usually also work with cash equivalents. By using electronic methods, the money system becomes more abstract.

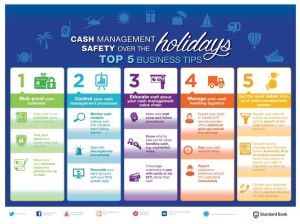

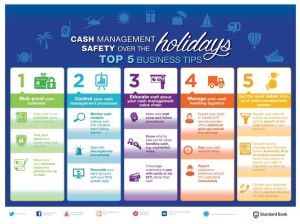

The top five business tips for managing cash flow and playing it safe over the holiday period:

- Safeguard your business against risk;

- Stay informed about your cash management processes;

- Educate your staff about your cash management value chain;

- Manage your cash handling logistics; and

- Extract the most value from your cash management system.

[click on image for enlargement]

- 5 tips for cash management (Standard Bank)

[Read full article]

Latest Annual Report on Employment Equity

Date posted: 11.04.2014 | Author: Harry Bovensmann

The latest annual report of the Commission on Employment Equity (CEE) shows a slightly improved picture for black advancement into desirable jobs, but no radical changes from the last comparable one that was done two years ago:

- with 4 984 large employers contributing information this year, the sample now seems to cover a significant part of the formal economy. The employers covered employ 5.6 million of the 8.5 million employees in the formal sector. In these companies

- there are 22 571 jobs categorised as “top management” of which 19.8% belong to black African employees. Whites have 62.7% of the top jobs.

- of the 84 527 “senior managers”, 23% are black, 7% coloured, 10.1% Indian and 57% white.

- of f the 417 996 “professional” employees, 38.4% are African, 9.6% are coloured, 9.4% are Indian and 40.6% are white.

- of the 1 447 224 “skilled” employees, 59.2% are African, 11.3% are coloured, 5.9% are Indian and 22% are white.

- of the 1 914 429 “semiskilled” employees, 75.7% are African, 11.6% coloured, 3.2% Indian and 6.7% white.

- of the 965 696 “unskilled” employees, 85.2% are African, 9.8% are coloured, 0.9% Indian and 1% are white.

At the release of the new CEE report, Labour Minister Mildred Oliphant lashed out at critics of employment equity as well as of the new regulations her department recently released for comment. She stressed that the regulations cover many different aspects of the EE regime and include a new formula for calculating the EE targets in different provinces, given the different demographics. The new formula would make employers use mostly national demographics with some adjustments for provincial numbers.

[Read full article]

[CEE Annual Report 2013-14]

Tax information exchange agreed upon between South Africa and USA

Date posted: 04.04.2014 | Author: Harry Bovensmann

The exchange of tax information to become true after the wording of a draft inter-governmental agreement (IGA) has now been agreed upon between South Africa and the USA. The agreement will be signed at governmental level as soon as possible announced the South African Revenue Service (SARS) in a statement on 3 March 2014.

Tax (Photo credit: 401(K) 2013)

After the double tax agreement has been signed, the US Treasury will view South African financial institutions as being generally compliant with the Foreign Account Tax Compliance Act (Fatca). Once the IGA takes effect, relevant financial institutions in South Africa would report required information to SARS which would exchange tax information with the US under the legal framework provided by the double taxation agreement that existed between both countries.

This meant financial institutions in South Africa would be required to obtain information on US citizens in accordance with the IGA, from July 1 and report the information to SARS. The first reporting period is 1 July 2014 to 28 February 2015, and the required information will have to be submitted to SARS by June 2015.

The tax information will thereafter be submitted annually for every tax year ending February, announced SARS. Additionally, SARS underlined they would play a leading role globally in moving towards greater transparency and exchange on information in tax matters. This ensured greater trust and fairness in the international tax system.

[Find here the full article]

[Click here for the Double Tax Agreement with the USA]

Retirement reform and non-retirement tax free savings

Date posted: 20.03.2014 | Author: Harry Bovensmann

National Treasury published papers providing details on the proposed retirement reforms and tax free savings products as announced in the budget speech 2014.

The two documents follow on the initial overview document on retirement reform, titled “Strengthening Retirement Savings: Overview of the 2012 Budget Proposals” (May 2012). The documents are also consistent with the shift towards a Twin Peaks system of regulating the financial sector, as initiated by the publication of the document titled “A safer financial sector to serve South Africa better” (February 2011). National Treasury claims in particular, to ensure that customers or members of retirement funds are treated fairly at all times, including after they retire.

1) 2014 Budget update on retirement reforms

This document provides more details on the retirement reform announcements made by the Minister of Finance in his 2014 Budget Speech. The document proposes a range of measures to lowering costs, built on a foundation of a mandatory contribution system, optimal preservation, consolidation, and further outlines short, medium and long term reforms in the retirement industry. Additionally, this document summarises the process of retirement reform from 2011 until the present, and lays out a future direction for the implementation of reforms over the next few years.

The broad policy goals of the intended reforms are:

- Implementing auto-enrolment or a mandatory contribution system

- Improving preservation

- Improving fund disclosure

- Getting defaults right

- Consolidating funds

- Simplifying retirement savings products and making them portable between providers

- Ensuring effective intermediation

- Providing tougher market conduct regulation and more effective supervision

This document (read with the policy paper titled “2013 Retirement reform proposals for further consultation”) will form the basis for engaging with key stakeholders (trade unions, trustees, employers, industry).

Any new or further comments on this paper can be submitted by 30 April 2014 to Ms. Alvinah Thela, Director: Retirement Funds by email to [email protected] or per facsimile to (012) 315 5206.

Find the document here: [2014 Budget Update on Retirement Reforms]

2) Non-retirement savings: tax free savings accounts

This document provides more details on the non-retirement savings reform announcements made by the Minister of Finance in his 2014 Budget Speech and the Budget Review. This document lays the basis for the legislation that will be published for public comment by July 2014, and for tabling and enactment thereafter in the newly-elected Parliament before the end of the year. This document incorporates revisions to the original proposal based on comments received and from subsequent consultations. It also provides an outline of the administrative requirements and procedures for these accounts.

The revised proposal now retains the current interest income exemptions, but it is not intended that the exemptions increase with inflation. This approach should allow a sufficient time for individuals to restructure their financial affairs. Individuals will be allowed to open one or two accounts, where they may invest in either interest bearing or equity instruments or both types of investments in each account, but total contributions for the tax year may not exceed the annual limit, initially to be R30 000. Unnecessary withdrawals will be discouraged by not permitting replacement of withdrawn amounts. A lifetime limit of R500 000 will also apply.

Not all market savings or investment products may be appropriate for inclusion in these tax free savings accounts. Products with contractual periodic contribution obligations (such as insurance contracts) or excessively high early termination charges are not considered appropriate. National Treasury and FSB will engage with industry in determining a reasonable early termination charge.

This document seeks to outline a set of principles and characteristics that products should abide by. These include simplicity, transparency and suitability. Direct share purchases will not be allowed although most exchange traded funds (ETFs) will qualify.

Comments on the paper Non-retirement savings: tax free savings accounts may be submitted by 30 April 2014, to Mr Chris Axelson, Director: Personal Income Taxes and Savings, Economic Tax Analysis, Private Bag X115, Pretoria, 0001 or by fax to 012 315 5516 or by email to: [email protected].

Find the document here: [2014 Tax free Savings Accounts]